Grow Financial Federal Credit Union (FCU) is recognized as one of the most reliable financial institutions in the United States, offering a diverse array of services tailored to its members. Whether you're establishing direct deposits, initiating fund transfers, or managing bill payments, understanding your Grow Financial FCU routing number is fundamental. In this article, we will explore everything you need to know about Grow Financial FCU routing numbers, empowering you to manage your finances with confidence and efficiency.

For many individuals, particularly those unfamiliar with banking terminology, navigating the routing number system can feel daunting. However, armed with the right knowledge, you can simplify the complexities of the financial landscape. This guide will provide a step-by-step approach to understanding the significance of routing numbers, how to locate them, and their practical applications in everyday banking.

As a member of Grow Financial FCU, having access to accurate and reliable information is essential for maintaining financial stability. This article is crafted to deliver actionable insights and practical advice, enabling you to make informed decisions regarding your financial transactions.

- What Is Ozempic Face Before And After

- The Lemont Restaurant Pittsburgh

- Garden Innavannah

- Hilton Hotels On Duvaltreet Key West

- Jaguars Qbs

Understanding the Role of Routing Numbers

A routing number, formally known as an ABA routing transit number, is a nine-digit code that serves as the backbone of the U.S. banking system. It is used to identify financial institutions, ensuring that funds are transferred to the correct bank or credit union during various transactions. For Grow Financial FCU members, the routing number is indispensable for conducting a wide range of banking activities.

Why the Grow Financial FCU Routing Number Matters

The Grow Financial FCU routing number functions as a unique identifier for the credit union, playing a pivotal role in facilitating accurate and efficient transactions. Below are some key reasons why the routing number is crucial:

- It enables seamless direct deposits from employers into your account.

- It facilitates electronic fund transfers between accounts, ensuring funds are directed to the appropriate destination.

- It supports bill payments and automated payment systems, allowing you to manage recurring expenses effortlessly.

- It ensures the smooth execution of wire transfers to and from other financial institutions, both domestically and internationally.

An In-Depth Look at Grow Financial FCU Routing Numbers

Grow Financial FCU utilizes a specific routing number for all financial transactions, maintaining consistency across all branches. This uniformity simplifies the process for members, allowing them to manage their accounts with ease. Below is a comprehensive overview of the routing number and its significance in banking operations.

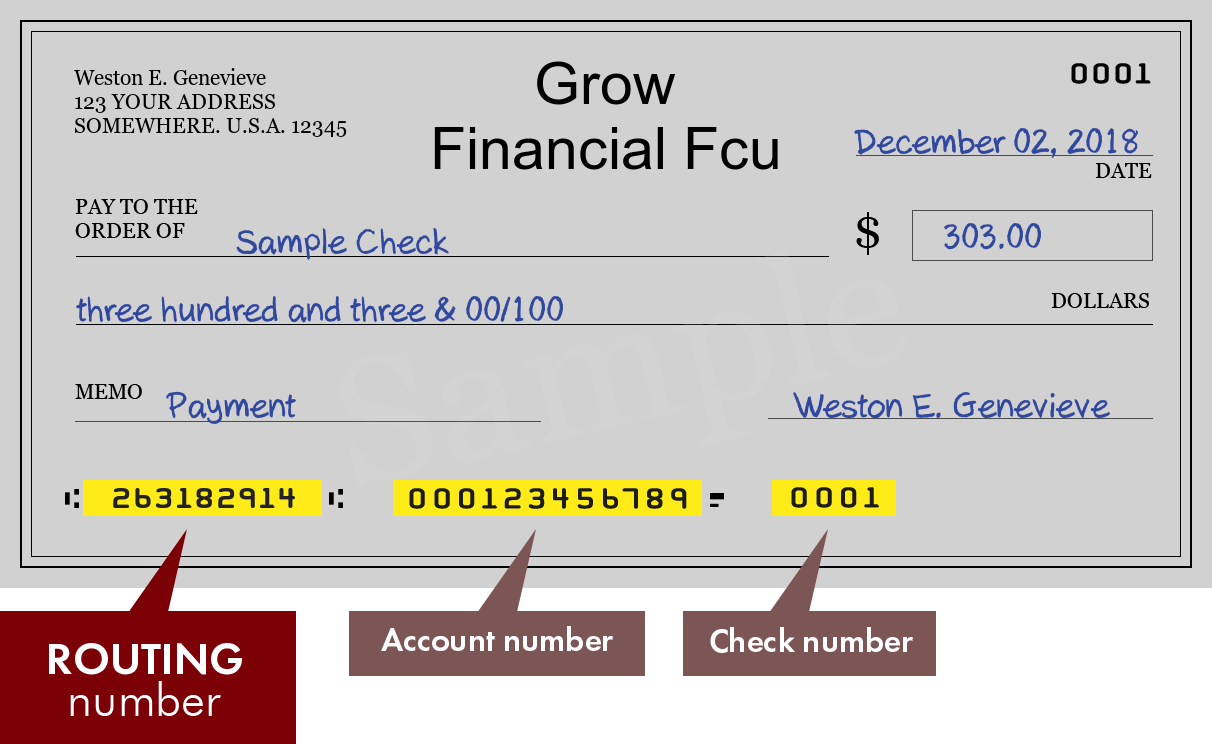

Locating Your Grow Financial FCU Routing Number

Identifying your Grow Financial FCU routing number is a straightforward process. Here are several methods to locate it:

- Check Your Checks: The routing number is conveniently printed on the bottom left-hand corner of your personal checks, making it easily accessible for reference.

- Online Banking: By logging into your Grow Financial FCU online banking account, you can navigate to the account details section, where the routing number is clearly displayed.

- Contact Customer Service: For additional assistance, reach out to Grow Financial FCU's dedicated customer service team, who can provide guidance in locating your routing number.

Practical Applications of Your Grow Financial FCU Routing Number

Knowing how to effectively use your Grow Financial FCU routing number can significantly enhance your banking experience. Below are some common applications:

Setting Up Direct Deposits

One of the most frequent uses of a routing number is establishing direct deposits. By providing your employer with the correct routing number, you can ensure that your paycheck is automatically deposited into your Grow Financial FCU account, eliminating the need for manual check processing.

Managing Bill Payments

Many utility companies and service providers offer the convenience of electronic bill payments. By utilizing your Grow Financial FCU routing number, you can set up automatic payments, ensuring that your bills are consistently paid on time and reducing the risk of late fees.

Considerations for Grow Financial FCU Routing Numbers

While Grow Financial FCU employs a single routing number for all its branches, it is crucial to verify the number before initiating any transactions. Errors in the routing number can lead to delays or incorrect transfers. Below are some considerations to keep in mind:

Domestic vs. International Transactions

For transactions conducted within the United States, the standard Grow Financial FCU routing number applies. However, for international wire transfers, a separate SWIFT code may be required. Always consult with Grow Financial FCU's customer service team to confirm the appropriate codes for your specific transaction needs.

Protecting Your Grow Financial FCU Routing Number

Your Grow Financial FCU routing number is a sensitive piece of information that requires careful protection. Sharing it unnecessarily can expose you to potential fraudulent activities. Below are some strategies to safeguard your routing number:

- Limit sharing your routing number to trusted entities, such as your employer or utility providers, to minimize the risk of unauthorized access.

- Regularly monitor your account for any suspicious or unauthorized transactions, promptly reporting any discrepancies to Grow Financial FCU.

- Enable two-factor authentication for added security, ensuring that only authorized individuals can access your account information.

Frequently Asked Questions About Grow Financial FCU Routing Numbers

Many Grow Financial FCU members have questions about routing numbers. Below are some commonly asked questions and their answers:

Can I Use the Same Routing Number for All Transactions?

Yes, Grow Financial FCU utilizes a single routing number for all transactions. However, it is always advisable to verify the number with the credit union to ensure accuracy and avoid potential complications.

What Are the Consequences of Providing an Incorrect Routing Number?

Providing an incorrect routing number can result in delayed or failed transactions, causing inconvenience and potential financial losses. It is essential to double-check the routing number before initiating any financial activity to ensure smooth processing.

Grow Financial FCU: A Pillar of Trust in the Financial Industry

Grow Financial FCU has solidified its reputation as a dependable and trustworthy financial institution, prioritizing member satisfaction and financial well-being. The credit union offers an extensive range of services designed to cater to the diverse needs of its members, fostering a sense of community and financial empowerment.

The Advantages of Joining Grow Financial FCU

Becoming a member of Grow Financial FCU unlocks a multitude of benefits, including:

- Competitive interest rates on loans and savings accounts, allowing you to maximize your financial growth and savings potential.

- Access to state-of-the-art banking technology and mobile apps, providing you with the tools to manage your finances conveniently and efficiently.

- Dedicated customer service support, ensuring that your banking experience is seamless and that your financial needs are met with professionalism and care.

Final Thoughts

In summary, understanding and utilizing your Grow Financial FCU routing number is essential for managing your finances effectively. From setting up direct deposits to facilitating bill payments, the routing number plays a vital role in ensuring secure and efficient transactions. By following the guidelines outlined in this article, you can navigate the banking process with confidence and peace of mind.

We encourage you to share this article with others who may benefit from the information. Additionally, feel free to leave a comment or question below. For more informative content on personal finance and banking solutions, explore our other articles and resources.

Table of Contents

- Understanding the Role of Routing Numbers

- Why the Grow Financial FCU Routing Number Matters

- An In-Depth Look at Grow Financial FCU Routing Numbers

- Locating Your Grow Financial FCU Routing Number

- Practical Applications of Your Grow Financial FCU Routing Number

- Considerations for Grow Financial FCU Routing Numbers

- Protecting Your Grow Financial FCU Routing Number

- Frequently Asked Questions About Grow Financial FCU Routing Numbers

- Grow Financial FCU: A Pillar of Trust in the Financial Industry

- The Advantages of Joining Grow Financial FCU

Detail Author:

- Name : Micheal Lindgren

- Username : koch.ellsworth

- Email : kari38@gmail.com

- Birthdate : 1978-09-22

- Address : 9948 Marcelo Cliff Apt. 287 Lake Antoniettaland, KY 53683-0974

- Phone : +1.931.719.1376

- Company : Durgan-Hauck

- Job : Dredge Operator

- Bio : Optio dolorum reiciendis ut aut qui iusto. Magnam ducimus aliquam hic aliquid. Rem tempore ab quos esse reiciendis.

Socials

tiktok:

- url : https://tiktok.com/@charvey

- username : charvey

- bio : Et deserunt ducimus dolor ex id rem. Esse enim beatae ad dolores hic quas quas.

- followers : 1425

- following : 706

twitter:

- url : https://twitter.com/carter_xx

- username : carter_xx

- bio : Ipsam dolores repudiandae alias quia magnam id ex. Qui delectus omnis sit hic. Quibusdam sint unde dolor in.

- followers : 4832

- following : 378

facebook:

- url : https://facebook.com/harvey1995

- username : harvey1995

- bio : Voluptatem ipsum amet qui et voluptates numquam.

- followers : 387

- following : 1363

instagram:

- url : https://instagram.com/carterharvey

- username : carterharvey

- bio : Qui unde et quibusdam. Ut tenetur consectetur natus. Assumenda ex nam placeat autem.

- followers : 2592

- following : 427