In today's highly competitive economic landscape, optimizing revenue has become a critical focus for both individuals and businesses. Whether you're a freelancer, small business owner, or corporate professional, discovering effective ways to boost your income is essential for long-term financial stability. This article will provide actionable insights and proven strategies to help you achieve financial success.

In the modern financial world, growth is not merely about increasing earnings; it involves optimizing resources, seizing opportunities, and adopting intelligent strategies that align with your personal or business objectives. This comprehensive guide will delve into various aspects of revenue generation, including budgeting, investment, and entrepreneurship. By the end of this article, you will have a well-defined roadmap to sustainably enhance your earnings.

Understanding the concept of "my revenue" extends far beyond the numbers on your paycheck. It encompasses creating multiple income streams, managing expenses prudently, and continuously adapting to evolving market trends. Let's explore in detail how you can take charge of your financial future and unlock your full earning potential.

- Buffalo Bills Quarterback History

- Who Played Lurch On Addams Family

- How Old Mayweather

- Road Closures In Kansas

- Theaters Inalinas Ca

Unpacking the Concept of Personal Revenue

At its essence, personal revenue refers to the total income generated by an individual or business over a defined period. This includes all forms of income, such as salaries, investment returns, side hustles, and business profits. To effectively manage and expand your revenue, it's vital to understand the different elements that contribute to it.

Key Components of Revenue:

- Primary Income Source: Your main job or business activity

- Secondary Income Streams: Additional gigs, investments, or passive income sources

- Non-Monetary Benefits: Perks, bonuses, and other financial incentives

Gaining a thorough understanding of these components enables you to pinpoint areas where you can potentially enhance your earnings. For instance, if your primary income source is steady but limited, exploring secondary income streams could significantly amplify your overall revenue.

- Fantasyfactory

- Bogo Wings Thursday

- St Jude Golf

- Beard Growth Oil Does It Work

- Moody Blues Question Lyrics

Debunking Common Myths About Revenue

Many people harbor misconceptions about increasing revenue, believing it solely involves working harder or longer hours. While effort is undoubtedly important, focusing on working smarter is equally critical. Below are some prevalent misconceptions:

- Working more hours always translates to earning more money

- Investing is exclusively for the wealthy

- Side hustles demand excessive time and effort

Addressing these misconceptions is the first step in formulating a realistic and effective strategy for revenue growth.

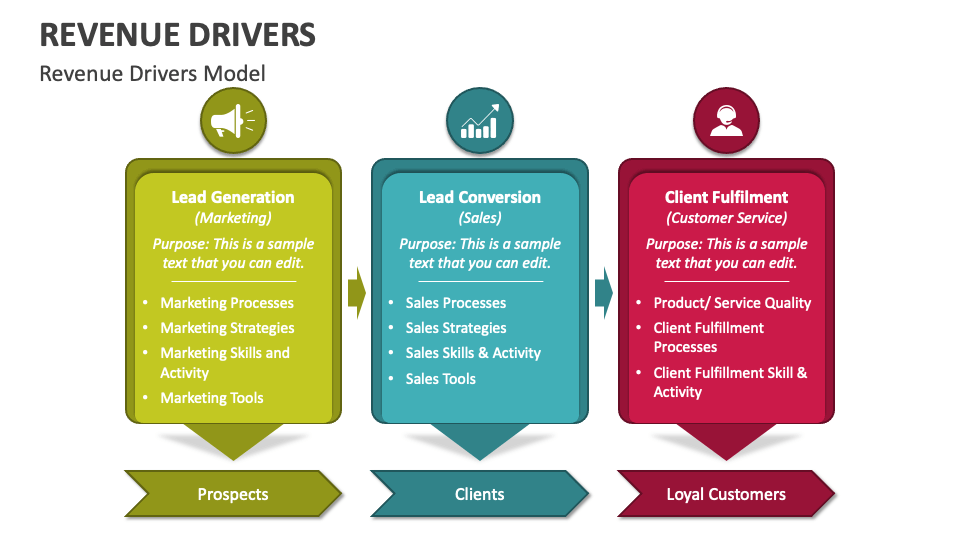

Identifying Your Diverse Revenue Streams

Before you can optimize your revenue, you need to identify all your existing income sources. This entails conducting a thorough assessment of your financial situation and recognizing opportunities for diversification.

Primary vs Secondary Revenue Streams

Your primary revenue stream is typically your main job or business. Secondary streams can include:

- Freelancing or consulting services

- Investment dividends

- Rental income from properties

- Online businesses or e-commerce ventures

Research indicates that individuals with multiple revenue streams tend to enjoy greater financial stability and growth. A study by the Federal Reserve revealed that those with diversified income sources reported higher overall satisfaction and reduced financial stress.

Strategies to Amplify Your Revenue

Once you've identified your revenue streams, it's time to implement strategies for growth. These strategies should be tailored to your unique circumstances and objectives.

Investing in Professional Development

Enhancing your skills can have a direct and significant impact on your earning potential. Consider the following approaches:

- Enrolling in online courses to acquire new skills

- Participating in workshops and seminars for hands-on learning

- Seeking mentorship from experienced professionals in your industry

Data from the Bureau of Labor Statistics highlights that workers who invest in continuous learning experience faster career advancement and higher wages compared to those who do not.

Mastering Expense Management for Revenue Maximization

Efficient expense management is crucial for maximizing revenue. By controlling costs, you can allocate more resources toward income-generating activities.

Crafting a Comprehensive Budget

A well-structured budget enables you to track spending and identify areas for improvement. Key steps include:

- Listing all monthly expenses in detail

- Categorizing spending into essential and non-essential categories

- Setting realistic limits for each spending category

According to a survey by the National Endowment for Financial Education, individuals who maintain a budget are more likely to achieve their financial goals and increase their revenue over time.

Exploring Lucrative Investment Opportunities

Investments can yield substantial returns and diversify your revenue streams. However, it's essential to approach them with caution and thorough research.

Types of Investment Options

Consider the following investment avenues:

- Stocks and bonds for market-based returns

- Real estate for long-term appreciation and rental income

- Mutual funds for diversified portfolio management

- Retirement accounts for secure financial planning

The Securities and Exchange Commission advises investors to diversify their portfolios and avoid concentrating all funds in a single investment vehicle to mitigate risk.

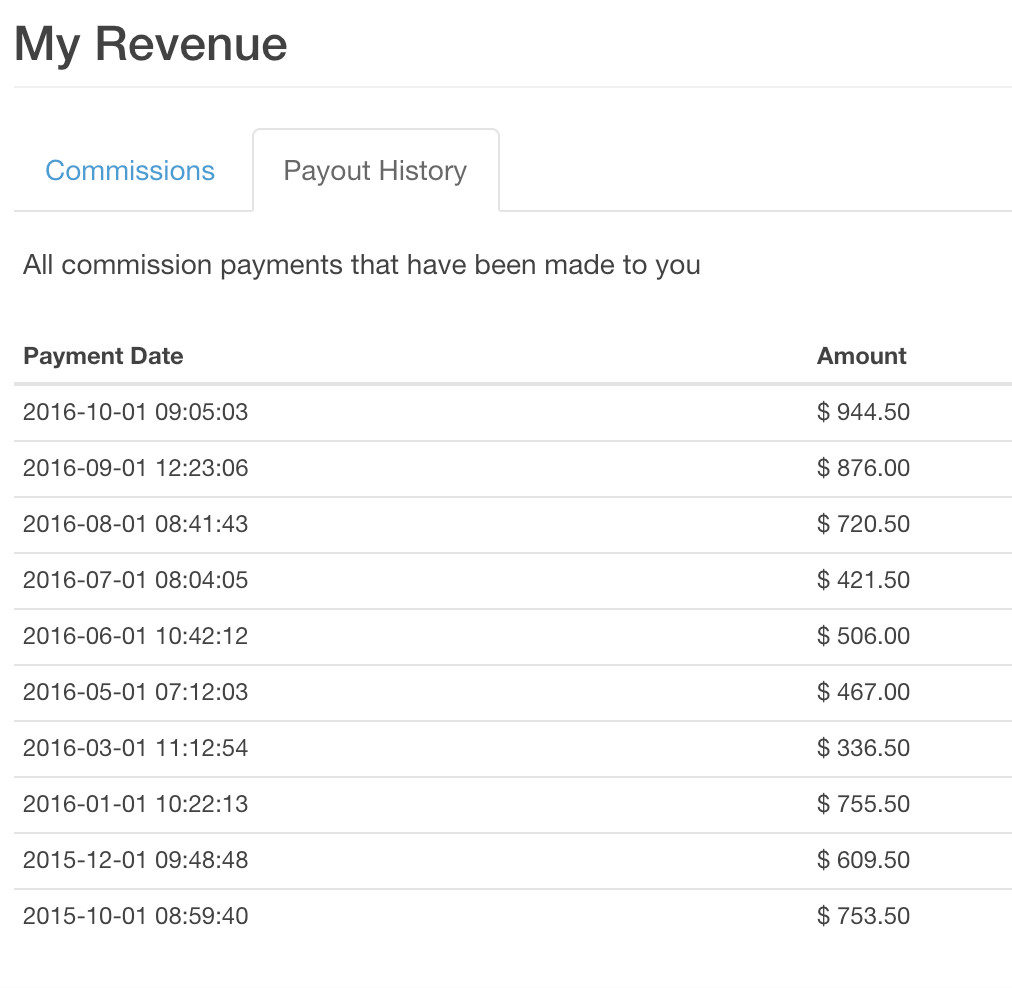

Constructing Passive Income Streams

Passive income can provide consistent revenue with minimal ongoing effort. Some popular options include:

Examples of Passive Income Sources

- Rental properties generating steady cash flow

- Dividend-paying stocks providing regular payouts

- Online courses or eBooks offering recurring sales

- Interest from high-yield savings accounts

Forbes reports that individuals who establish multiple passive income streams often experience faster financial growth and greater stability compared to those relying solely on active income.

Overcoming Challenges in Revenue Growth

While increasing revenue offers numerous advantages, it also presents challenges. Understanding these obstacles is key to overcoming them effectively.

Common Obstacles in Revenue Growth

- Time management to balance multiple income streams

- Financial risk associated with investments and new ventures

- Market fluctuations affecting revenue stability

Experts recommend developing contingency plans and maintaining a robust support network to navigate these challenges successfully.

Evaluating Success and Refining Strategies

To ensure your revenue growth efforts are effective, it's crucial to regularly assess your progress and make necessary adjustments.

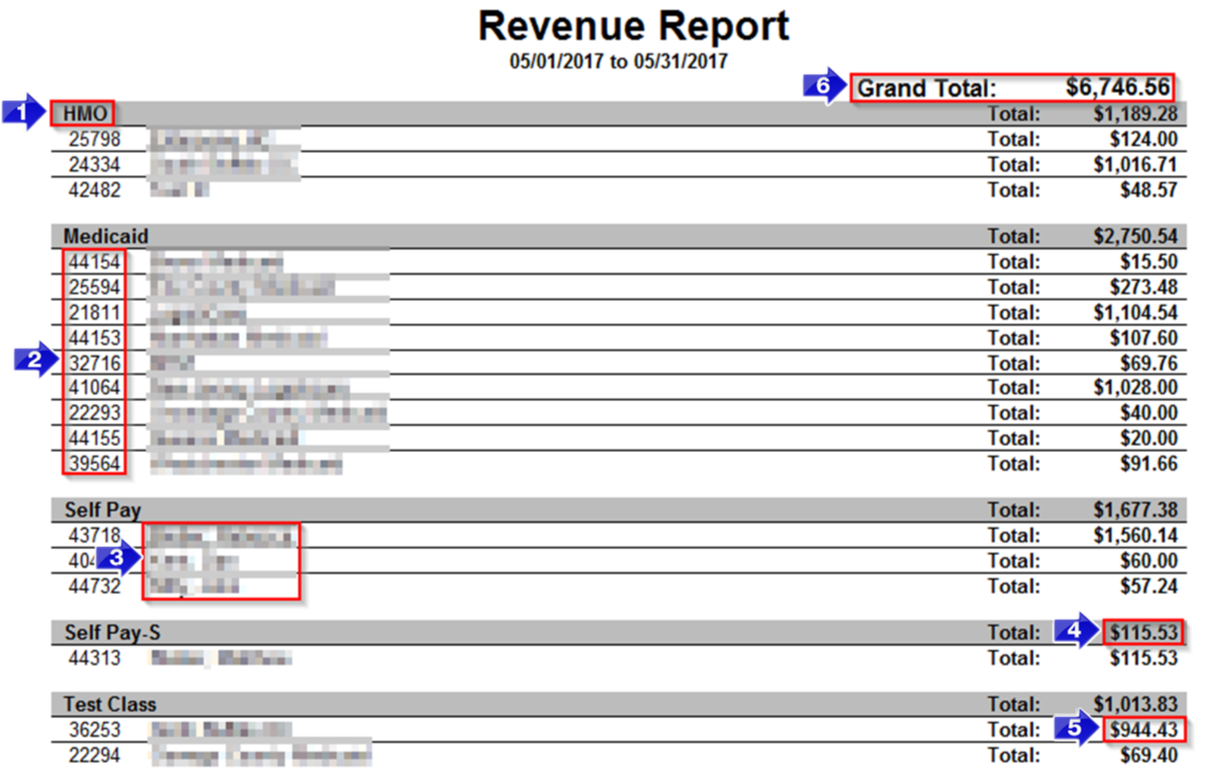

Key Performance Indicators (KPIs) for Success

Track the following metrics to measure success:

- Monthly income growth rate to gauge progress

- Expense-to-income ratio to monitor financial health

- Investment return on investment (ROI) to evaluate profitability

Research from the Harvard Business Review suggests that regularly monitoring KPIs leads to better decision-making and more successful outcomes in revenue management.

Conclusion: Empowering Your Financial Future

In conclusion, maximizing your revenue requires a strategic approach that combines thoughtful planning, skill enhancement, and prudent financial management. By identifying all your income sources, exploring new opportunities, and continuously evaluating your progress, you can achieve sustainable financial growth.

We encourage you to take action by implementing the strategies discussed in this article. Share your thoughts and experiences in the comments below, and consider exploring other articles on our site for additional insights into financial success. Remember, your financial future is in your hands—start building it today!

Table of Contents

- Unpacking the Concept of Personal Revenue

- Identifying Your Diverse Revenue Streams

- Strategies to Amplify Your Revenue

- Mastering Expense Management for Revenue Maximization

- Exploring Lucrative Investment Opportunities

- Constructing Passive Income Streams

- Overcoming Challenges in Revenue Growth

- Evaluating Success and Refining Strategies

Detail Author:

- Name : Miss Thalia Fadel

- Username : turner.kasandra

- Email : laverna.hoppe@bernhard.com

- Birthdate : 1997-03-30

- Address : 9081 Emile Mission South Janefurt, CT 74483-2117

- Phone : 1-341-598-4653

- Company : Funk-McGlynn

- Job : Surveying Technician

- Bio : Nihil eaque necessitatibus rerum quisquam. Molestias incidunt consequatur consequatur reprehenderit delectus et.

Socials

twitter:

- url : https://twitter.com/jimmie7567

- username : jimmie7567

- bio : Ut accusamus nostrum incidunt sit est hic. Molestiae voluptas quos commodi laborum non.

- followers : 5382

- following : 507

instagram:

- url : https://instagram.com/jimmie_id

- username : jimmie_id

- bio : Amet illum et quae. Tenetur facilis ex reprehenderit. Sit qui placeat voluptatem aut quasi quis.

- followers : 490

- following : 1546