Overlooking the submission of a W2 form can lead to significant repercussions for both employers and employees. This document serves as the official record of an employee's annual income and taxes withheld, making it a vital element in the tax reporting process. Missing the deadline for filing this form can result in penalties, audits, and potential legal challenges. In this article, we will delve into the significance of W2 forms, the ramifications of neglecting to file, and the corrective measures that can be taken.

Each year, countless employers and employees navigate the complexities of tax-related documentation, with the W2 form being one of the most critical components. It ensures adherence to federal and state tax laws. However, given the intricacies of tax regulations and the pressure of deadlines, oversights can occur. Recognizing the implications of neglecting to file a W2 form is essential for preserving financial stability and avoiding unnecessary complications.

Our aim is to offer a comprehensive and actionable guide for anyone who has neglected to file a W2. By the conclusion of this article, you will possess a clear understanding of the necessary steps, the penalties involved, and strategies to prevent such errors in the future. Let’s get started!

- Outlet Centermithfield Nc

- S In Walnut Creek

- What Is Daily Mail

- Actor Dean Butler

- Buffalo Bills Quarterback History

Table of Contents

- The Importance of W2 Forms

- Consequences of Neglecting to File a W2

- Understanding the W2 Filing Process

- How to Address a Neglected W2 Filing

- Penalties for Late or Missing W2 Forms

- Tips for Preventing Future Errors

- Resources for Employers and Employees

- Legal Implications of Not Filing a W2

- Common Questions About W2 Forms

- Conclusion and Next Steps

The Importance of W2 Forms

W2 forms hold a central role in the tax reporting process. They provide a detailed overview of an employee’s earnings, taxes withheld, and other vital financial details. Employers are obligated to issue W2 forms to their employees by January 31st annually, ensuring that employees have the required documentation to accurately file their taxes.

For employees, the W2 form is indispensable for calculating tax liabilities, claiming refunds, and maintaining compliance with IRS regulations. Without this document, individuals may encounter challenges in filing their taxes on time or receiving accurate refunds, potentially leading to further complications.

Key Components of a W2 Form

- Employee’s name, address, and Social Security Number (SSN)

- Employer’s name, address, and Employer Identification Number (EIN)

- Total wages, tips, and other forms of compensation

- Federal, state, and local taxes withheld

- Medicare and Social Security wages and taxes withheld

Each of these components ensures transparency in financial obligations and contributions for both employers and employees.

- Who Playsally In The Nightmare Before Christmas

- Calling Amazon

- How Old Jack Black

- Joe Biden Political Career

- La Catrina Mexican Grill

Consequences of Neglecting to File a W2

Overlooking the filing of a W2 form can lead to substantial consequences for both employers and employees. The IRS treats this matter with seriousness, as it directly affects tax compliance and revenue collection. Employers who fail to file W2 forms on time may face penalties, while employees may experience delays in receiving tax refunds or face scrutiny during audits.

Potential Challenges for Employers

- Financial penalties for late or missing filings

- Increased likelihood of audits and legal action

- Damage to employer reputation and employee trust

Potential Challenges for Employees

- Delayed tax filings and refunds

- Possible penalties for late tax submissions

- Difficulties proving income for loans or other financial applications

Recognizing these consequences underscores the importance of timely W2 filings and the necessity of corrective action when errors occur.

Understanding the W2 Filing Process

The W2 filing process involves several essential steps that employers must follow to ensure compliance. From gathering employee data to submitting forms electronically or via mail, each step plays a crucial role in accurate reporting.

Steps to File a W2 Form

- Gather employee information, including SSN, address, and wages

- Complete the W2 form using IRS-approved software or manually

- Send copies of the W2 form to employees by January 31st

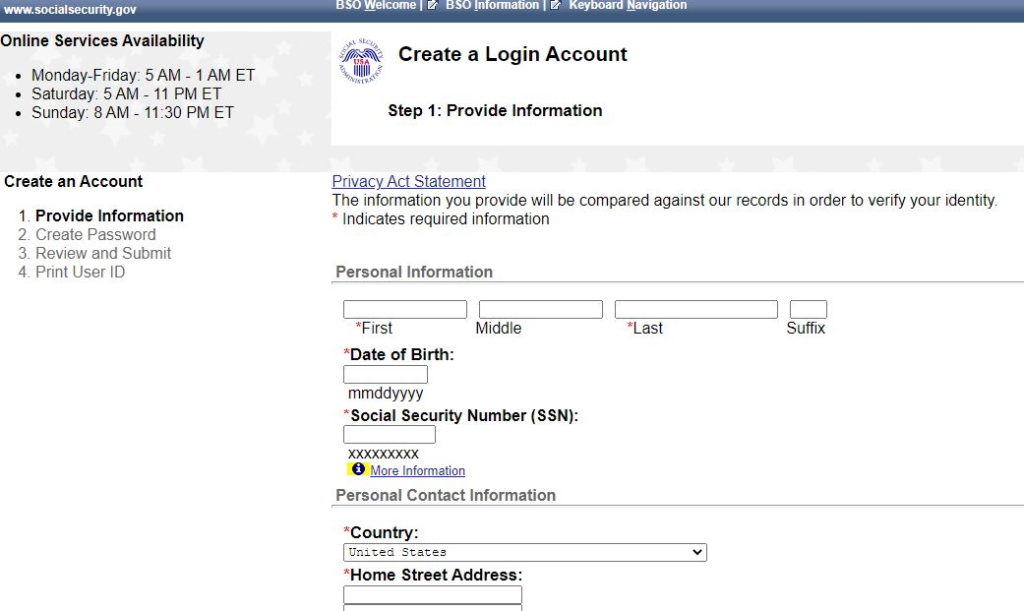

- Submit copies to the Social Security Administration (SSA) by the deadline

Employers who opt for electronic filing can simplify the process and minimize the risk of errors. The IRS provides detailed guidelines for electronic filing, ensuring a seamless and efficient submission process.

How to Address a Neglected W2 Filing

If you have neglected to file a W2 form, it is crucial to take prompt action to rectify the situation. The IRS offers specific procedures for correcting late or missing filings, ensuring compliance without further complications.

Steps to Address a Neglected W2 Filing

- Contact the SSA to report the oversight and request an extension if necessary

- Complete the W2 form using the most accurate data available

- Issue corrected forms to employees and submit them to the SSA promptly

By following these steps, employers can reduce penalties and avoid further issues with tax authorities.

Penalties for Late or Missing W2 Forms

The IRS enforces penalties for late or missing W2 filings to promote compliance and timely reporting. These penalties vary based on the severity of the delay and the number of forms involved.

Penalty Structure

- Up to $50 per form for late filings, with a maximum penalty of $165,000 per year

- Higher penalties for intentional disregard of filing requirements

- Additional penalties for failing to issue W2 forms to employees

Employers should prioritize timely filings to avoid costly penalties and maintain a positive relationship with tax authorities.

Tips for Preventing Future Errors

To avoid future oversights in W2 filings, employers can implement several best practices. These strategies ensure that all necessary documentation is completed and submitted on time, reducing the risk of penalties and audits.

Best Practices for W2 Filings

- Designate a dedicated team or individual responsible for tax reporting

- Utilize IRS-approved software for accurate and efficient filing

- Set reminders for key deadlines and conduct regular audits of employee data

By adopting these practices, employers can establish a robust system for managing W2 filings and maintaining compliance.

Resources for Employers and Employees

Both employers and employees have access to numerous resources to assist with W2 filings and related tax matters. These resources provide guidance, tools, and support to ensure accurate and timely submissions.

Recommended Resources

- IRS Publication 15: Employer’s Tax Guide

- Social Security Administration (SSA) website for W2 submission guidelines

- Online tax preparation software for employers and employees

These resources are invaluable for navigating the complexities of W2 filings and ensuring compliance with tax regulations.

Legal Implications of Not Filing a W2

Failing to file a W2 form can have significant legal implications, particularly for employers. Noncompliance with IRS regulations may result in legal action, fines, and damage to business reputation. Employees may also face legal challenges if they fail to report their income accurately due to missing W2 forms.

Legal Protections for Employees

- Employees can request a substitute W2 form from their employer

- They can file Form 4852 with the IRS if a W2 form is not provided

- Legal recourse is available for employees who suffer financial harm due to employer negligence

Understanding these legal protections empowers both employers and employees to effectively address W2-related issues.

Common Questions About W2 Forms

Here are some frequently asked questions about W2 forms and their answers:

Q: What should I do if I don’t receive my W2 form?

A: Contact your employer immediately to request a copy. If they fail to provide it, file Form 4852 with the IRS as a substitute for your W2 form.

Q: Can I file my taxes without a W2 form?

A: Yes, you can file your taxes using Form 4852, but it is advisable to obtain your W2 form whenever possible for greater accuracy.

Q: How can employers avoid W2 filing errors?

A: Employers should use IRS-approved software, conduct regular audits of employee data, and establish clear processes for W2 filings.

Conclusion and Next Steps

Overlooking the submission of a W2 form can lead to serious consequences, but with the appropriate knowledge and tools, you can address and prevent these issues. This guide has explored the significance of W2 forms, the ramifications of neglecting to file, and the steps to rectify the situation. By following the best practices outlined here, employers and employees can ensure compliance and avoid unnecessary complications.

We encourage you to take action by reviewing your W2 filing processes, accessing the recommended resources, and staying informed about tax regulations. Feel free to leave a comment or share this article with others who may find it helpful. Together, we can promote financial responsibility and compliance in the workplace.

Detail Author:

- Name : Destini Wyman

- Username : leanne.strosin

- Email : etrantow@hotmail.com

- Birthdate : 1989-02-07

- Address : 878 Kuhlman Squares Tressieland, VA 80969-8645

- Phone : +1-775-540-4409

- Company : Steuber Inc

- Job : Postal Service Mail Sorter

- Bio : Perferendis et dolore deserunt eum placeat. Omnis odit et voluptatem sint doloribus nam. Voluptatem aut iure adipisci rerum. Corporis rem cumque enim et.

Socials

tiktok:

- url : https://tiktok.com/@abe_xx

- username : abe_xx

- bio : Totam enim voluptatem officiis culpa aperiam asperiores repudiandae.

- followers : 6630

- following : 301

linkedin:

- url : https://linkedin.com/in/hamilla

- username : hamilla

- bio : Sunt ut ea praesentium est omnis vitae.

- followers : 1240

- following : 1862

twitter:

- url : https://twitter.com/ahamill

- username : ahamill

- bio : Rerum maxime sed voluptatem vel quia similique dolorem adipisci. Et ullam officiis quam incidunt necessitatibus eveniet ut. Sunt eius et dolorum.

- followers : 6759

- following : 2081

instagram:

- url : https://instagram.com/abe_hamill

- username : abe_hamill

- bio : Enim quam sunt dolores repellendus sed praesentium. Reiciendis consectetur veritatis tenetur dolor.

- followers : 1461

- following : 2887

facebook:

- url : https://facebook.com/abe_real

- username : abe_real

- bio : Quisquam sed illum aspernatur autem. Soluta a recusandae quidem consequatur.

- followers : 4588

- following : 2262