Property taxes represent a major financial commitment for homeowners in Los Angeles County, and understanding the intricacies of LACountyPropertyTax is essential for anyone navigating the real estate landscape in this region. Whether you're a first-time homeowner or an experienced real estate investor, managing property tax assessments, exemptions, and payment schedules can be challenging. This article is designed to simplify the complexities, offering actionable advice and valuable insights to help you effectively handle your property tax responsibilities.

Los Angeles County is renowned for its high-value real estate, and with it comes the obligation to pay property taxes. These taxes play a critical role in funding vital public services, including education, law enforcement, and infrastructure development. However, the property tax system can be intricate, leaving many homeowners bewildered by the rules and regulations.

This guide aims to provide a thorough examination of LACountyPropertyTax, covering everything from how property taxes are calculated to the exemptions available and strategies for reducing your tax burden. Whether you're seeking practical advice or in-depth analysis, this article will serve as your ultimate resource for property taxes in Los Angeles County.

- San Juan County Tax Assessor Nm

- Best Blue Oyster Cultongs

- Power Outage Entergy

- When Did Bob Marley Die Age

- South Bend A Breaking News

Table of Contents

- Understanding LACountyPropertyTax

- How Property Taxes Are Calculated

- Available Exemptions and Deductions

- Payment Options and Deadlines

- Appealing Your Property Tax Assessment

- Strategies to Reduce Property Taxes

- The Impact of Property Taxes on Homeownership

- A Brief History of Property Taxes in Los Angeles County

- Useful Resources for Homeowners

- Conclusion

Understanding LACountyPropertyTax

What Are Property Taxes?

Property taxes, often referred to as ad valorem taxes, are levied by local governments based on the assessed value of a property. In Los Angeles County, these taxes are a primary source of funding for public services. Homeowners are required to pay property taxes annually, and failure to comply can result in severe consequences, such as penalties, interest charges, or even property liens.

The LACountyPropertyTax system operates under the framework of state laws and local regulations. A clear understanding of these laws is crucial for homeowners to ensure compliance and avoid unnecessary financial burdens.

Why Are Property Taxes Important?

Property taxes are instrumental in financing a wide array of public services that contribute to community development and well-being. These services include:

- Public schools and educational programs

- Law enforcement agencies

- Fire protection services

- Road maintenance and infrastructure development

- Park and recreational facilities

By fulfilling your property tax obligations, you actively contribute to the growth and sustainability of your community, enhancing the quality of life for all residents.

How Property Taxes Are Calculated

The process of calculating LACountyPropertyTax involves multiple factors, including the assessed value of the property and the applicable tax rate. The assessed value is typically a percentage of the property's market value, while the tax rate is determined by local government entities.

Assessed Value vs. Market Value

It's important to recognize that the assessed value of your property may differ from its market value. In Los Angeles County, properties are assessed at a maximum of 1% of their market value, as mandated by Proposition 13. This means that even if your property's market value appreciates significantly, your tax bill will not increase proportionally, providing homeowners with a measure of financial stability.

Tax Rates in Los Angeles County

Tax rates vary across different regions within Los Angeles County, depending on the specific services provided by local jurisdictions. On average, homeowners can expect to pay approximately 1.25% of their property's assessed value in taxes annually. Understanding these rates is vital for accurate budgeting and financial planning.

Available Exemptions and Deductions

Los Angeles County offers several exemptions and deductions to help homeowners alleviate their property tax burden. These include:

- Homeowner's Exemption: This exemption reduces the assessed value of a primary residence by $7,000, resulting in lower tax payments and making homeownership more affordable.

- Senior Citizen Exemption: Homeowners aged 55 or older may qualify for additional tax relief if they meet certain income requirements, providing financial support for senior citizens.

- Disability Exemption: Disabled homeowners may be eligible for reduced property taxes based on their disability status, offering much-needed assistance to those in need.

To apply for these exemptions, homeowners must submit the necessary documentation to the Los Angeles County Assessor's Office. Proper application ensures that eligible homeowners receive the benefits they are entitled to.

Payment Options and Deadlines

Payment Deadlines

Property tax payments in Los Angeles County are due in two installments: the first by December 10 and the second by April 10. Missing these deadlines can lead to late fees, interest charges, and other penalties, making timely payment a priority for all homeowners.

Payment Methods

Homeowners have several convenient options for paying their property taxes:

- Online Payment: Pay securely via the Los Angeles County Tax Collector's website, providing a fast and efficient method for making payments.

- Mail-In Payment: Use the provided payment coupon to send your payment via mail, ensuring a reliable and traditional payment method.

- In-Person Payment: Visit designated payment centers for in-person transactions, offering flexibility for those who prefer face-to-face interactions.

Selecting the most convenient payment method can help ensure timely payments and prevent unnecessary fees, contributing to better financial management.

Appealing Your Property Tax Assessment

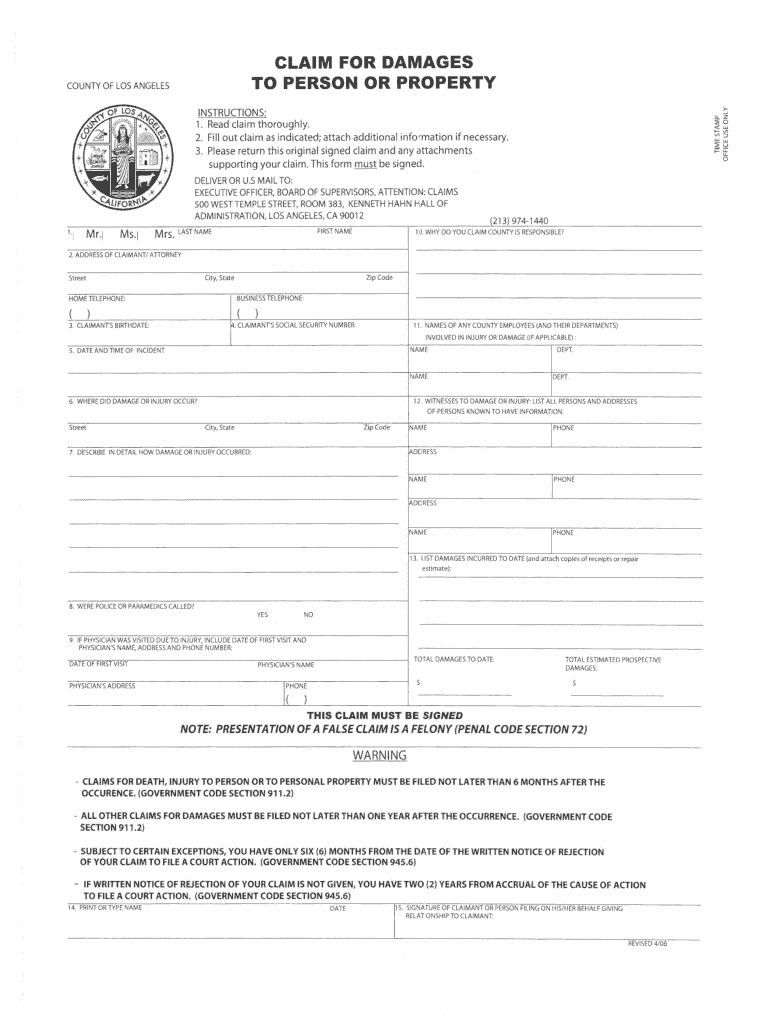

If you believe your property tax assessment is incorrect, you have the right to appeal. The appeals process involves submitting a formal request to the Los Angeles County Assessment Appeals Board, supported by evidence to substantiate your claim.

Steps to Appeal

- Gather comprehensive documentation, including comparable property assessments and current market value data, to strengthen your case.

- Submit your appeal application by the deadline, typically in July, to ensure your request is considered.

- Attend the appeal hearing and present your case to the board, providing clear and convincing evidence to support your appeal.

A successful appeal can lead to a reduced tax bill, saving homeowners significant amounts of money and ensuring a fair assessment process.

Strategies to Reduce Property Taxes

While property taxes are an unavoidable expense, homeowners can employ various strategies to minimize their tax burden. These include:

- Monitoring Property Assessments: Regularly review your property's assessed value for inaccuracies and discrepancies, allowing you to address issues promptly.

- Taking Advantage of Exemptions: Fully utilize available exemptions and deductions to lower your tax payments and maximize savings.

- Investing in Energy-Efficient Upgrades: Implement energy-efficient upgrades to potentially qualify for tax credits, reducing both your tax liability and environmental impact.

By staying informed and proactive, homeowners can effectively manage their property tax obligations while enjoying the benefits of homeownership.

The Impact of Property Taxes on Homeownership

Property taxes significantly influence the overall cost of homeownership. Understanding their impact is crucial for prospective buyers when evaluating potential property purchases. Factors such as property location, size, and amenities can all affect the amount of taxes owed, making careful consideration essential.

Planning for Property Taxes

When budgeting for homeownership, it's imperative to include property taxes as part of your monthly expenses. This proactive approach helps ensure financial stability and prevents unexpected financial strain, allowing homeowners to make informed decisions about their property investments.

A Brief History of Property Taxes in Los Angeles County

Property taxes have been a fundamental source of local government revenue in Los Angeles County for over a century. The introduction of Proposition 13 in 1978 revolutionized the property tax system by capping tax rates and limiting annual assessment increases. This landmark legislation has had a lasting impact on homeownership in California, providing stability, predictability, and financial security for property owners.

Useful Resources for Homeowners

For additional information on LACountyPropertyTax, homeowners can explore the following resources:

- Los Angeles County Assessor's Office: Offers detailed insights into property assessments and tax calculations.

- Los Angeles County Tax Collector's Website: Provides payment options, deadlines, and other essential details for property tax payments.

- California State Board of Equalization: Offers statewide resources and guidelines for property tax assessments and appeals.

These resources empower homeowners with the knowledge and tools necessary to navigate the property tax system effectively and confidently.

Conclusion

In summary, understanding LACountyPropertyTax is paramount for homeowners in Los Angeles County. By gaining a thorough understanding of how property taxes are calculated, the exemptions available, and strategies to reduce your tax burden, you can ensure compliance and maintain financial stability. We encourage you to share this article with fellow homeowners and explore additional resources to deepen your knowledge of property taxes.

Have questions or feedback? Leave a comment below, and don't hesitate to explore our other articles for more insightful information on real estate and finance.

Detail Author:

- Name : Arielle Ward

- Username : flatley.fay

- Email : patricia40@weimann.com

- Birthdate : 2001-08-26

- Address : 97148 Paxton Passage Suite 691 Goyettemouth, OH 68207

- Phone : 603.457.2323

- Company : Kuhn and Sons

- Job : Aircraft Launch Specialist

- Bio : Facilis consectetur corrupti odit corrupti nobis. Minima omnis provident deserunt provident sint eum quidem incidunt. Eligendi aut deleniti debitis iure. Veniam velit delectus ut vitae ut.

Socials

linkedin:

- url : https://linkedin.com/in/skunze

- username : skunze

- bio : Aut rerum voluptatem distinctio eligendi qui.

- followers : 2679

- following : 1068

instagram:

- url : https://instagram.com/kunze1986

- username : kunze1986

- bio : Sed quidem unde sunt dolore. Mollitia ad repellat hic. Excepturi temporibus voluptatum et placeat.

- followers : 2868

- following : 832

facebook:

- url : https://facebook.com/sofia_kunze

- username : sofia_kunze

- bio : Ab eaque quidem iure. Velit molestias sint ab voluptatem sed.

- followers : 823

- following : 1443

twitter:

- url : https://twitter.com/skunze

- username : skunze

- bio : Qui quasi asperiores laborum iusto beatae occaecati. Minus nemo ipsum id rerum. Corrupti cupiditate cum et doloremque.

- followers : 1768

- following : 2230