In the ever-evolving trading landscape, understanding MM2 trading values has become an indispensable skill for traders. As financial markets continue to grow in complexity, traders—both seasoned professionals and newcomers—must arm themselves with the knowledge and strategies necessary to navigate this dynamic environment successfully. By mastering MM2 trading values, traders can significantly enhance their performance and profitability, ensuring they remain competitive in the long term.

Trading is far more than the simple act of buying and selling assets; it is about comprehending the intricate factors that drive market movements. In this guide, we will delve deep into the complexities of MM2 trading values, exploring essential concepts, strategies, and tools that will empower you to succeed in this challenging field. By the end of this article, you will have a robust understanding of how MM2 trading values can be applied to maximize your trading potential.

This guide is designed to provide you with actionable insights and practical advice, equipping you with the tools you need to thrive in today’s fast-paced financial markets. Let’s dive in and begin your journey toward mastering MM2 trading values!

- The Lemont Restaurant Pittsburgh

- Alice Braga Moraes

- Norman Names

- Actor Dean Butler

- Tom And Jerry 2020 Cast

Table of Contents

- Understanding MM2 Trading Values

- Why MM2 Trading Values Matter

- Core Concepts in MM2 Trading

- Strategies for Effective MM2 Trading

- Essential Tools and Platforms for MM2 Trading

- Analyzing Markets Through MM2 Trading Values

- Managing Risk in MM2 Trading

- The Psychology Behind Successful MM2 Trading

- Ensuring Legal Compliance in MM2 Trading

- Emerging Trends in MM2 Trading Values

Understanding MM2 Trading Values

MM2 trading values encompass a broad array of factors that influence the trading process, including market conditions, asset valuation, and strategic decision-making. For traders seeking to make informed choices and achieve consistent profitability, understanding these values is paramount. At its heart, MM2 trading values focus on identifying the intrinsic worth of assets and determining the optimal timing for entering or exiting trades. By integrating these values into their strategies, traders can refine their decision-making processes and enhance their chances of success.

In this section, we will examine the foundational principles of MM2 trading values and how they can be applied to real-world trading scenarios. Additionally, we will explore the importance of staying updated on market trends and adapting to the ever-changing conditions of the financial landscape.

Why MM2 Trading Values Matter

MM2 trading values play a pivotal role in shaping the trading environment and influencing market outcomes. By grasping these values, traders can gain a competitive edge and make more informed decisions. The incorporation of MM2 trading values into your trading strategy offers several key benefits:

- Bluesongs Lyrics

- How Do I Order Checks From Chase

- Bogo Wings Thursday

- Wonder Woman Andteve Trevor

- How Old Jack Black

- Data-Driven Decision-Making: By leveraging data and analytics, traders can make more precise and informed decisions, reducing the reliance on guesswork.

- Increased Profitability: Identifying undervalued assets and capitalizing on market inefficiencies can lead to enhanced profitability over time.

- Effective Risk Management: Implementing robust risk management techniques helps mitigate potential losses and ensures long-term sustainability.

As financial markets continue to evolve, the significance of MM2 trading values will only increase. Staying informed and adapting to these changes is crucial for achieving long-term success in trading.

Core Concepts in MM2 Trading

Asset Valuation: Unlocking the True Worth of Assets

Asset valuation is a cornerstone of MM2 trading values. It involves determining the intrinsic value of an asset by analyzing various factors, such as financial performance, market conditions, and industry trends. Accurate asset valuation enables traders to make more informed decisions and identify profitable opportunities. Common methods of asset valuation include:

- Discounted Cash Flow (DCF) Analysis: A technique that estimates the value of an asset based on its expected future cash flows.

- Comparative Market Analysis: Comparing the asset to similar investments to gauge its relative value.

- Price-to-Earnings (P/E) Ratio: A metric that evaluates the relationship between a company’s stock price and its earnings per share.

By mastering these methods, traders can gain a deeper understanding of asset valuation and enhance their trading strategies.

Market Sentiment: Reading the Mood of the Market

Market sentiment refers to the collective attitude of investors toward a particular asset or market. Understanding market sentiment is essential for traders who wish to anticipate price movements and make timely trading decisions. Indicators of market sentiment include:

- Volatility Indices: Tools like the VIX measure the level of volatility in the market, providing insight into investor fear or confidence.

- Social Media Sentiment Analysis: Analyzing social media platforms to gauge public opinion on specific assets or markets.

- News Sentiment Analysis: Evaluating news articles and reports to assess the overall tone and sentiment surrounding an asset.

Incorporating market sentiment into your trading strategy allows you to stay ahead of emerging trends and capitalize on market shifts.

Strategies for Effective MM2 Trading

Position Trading: Capitalizing on Long-Term Trends

Position trading involves holding positions for extended periods, typically ranging from weeks to months. This strategy focuses on long-term trends and requires a strong foundation in fundamental analysis. Key elements of position trading include:

- Identifying Long-Term Trends: Recognizing and leveraging major market trends to maximize returns.

- Fundamental Analysis: Evaluating the underlying financial health and performance of assets to make informed decisions.

- Risk Management: Implementing position sizing techniques to manage risk effectively and protect your capital.

Day Trading: Profiting From Short-Term Movements

Day trading involves buying and selling assets within the same trading day. This high-paced strategy demands a solid grasp of technical analysis and the ability to make rapid decisions. Key aspects of day trading include:

- Technical Indicators: Using tools like moving averages and RSI to identify entry and exit points.

- Risk Management: Utilizing stop-loss orders to limit potential losses and safeguard your trading account.

- Market Awareness: Staying informed about market news and events that could impact short-term price movements.

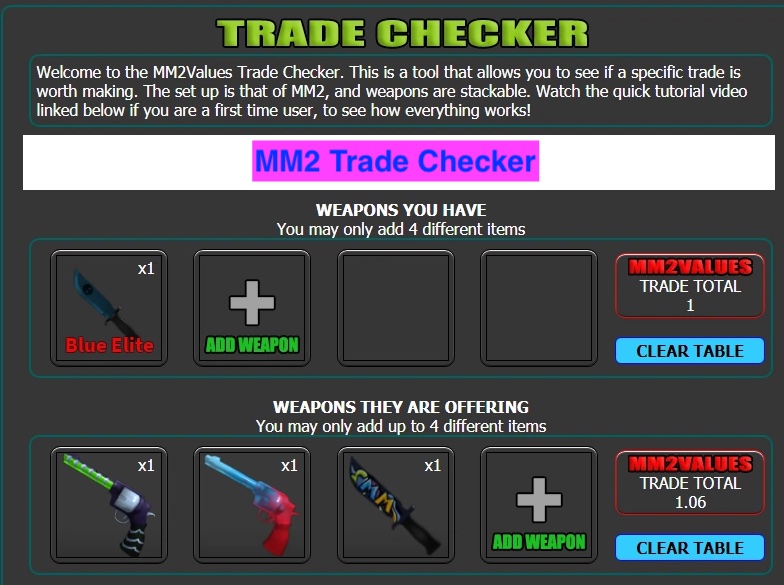

Essential Tools and Platforms for MM2 Trading

Trading Platforms: Your Gateway to the Markets

Harnessing the right trading platforms is critical for success in MM2 trading. These platforms provide traders with the tools they need to analyze markets, manage risk, and execute trades efficiently. Some of the most popular trading platforms for MM2 trading include:

- MetaTrader 4 (MT4): A widely used platform offering advanced charting tools and automated trading capabilities.

- MetaTrader 5 (MT5): An upgraded version of MT4, featuring enhanced functionality and real-time market data.

- eToro: A social trading platform that allows users to copy the trades of experienced traders.

These platforms empower traders with a wide array of features, enabling them to make informed decisions and execute trades with precision.

Market Analysis Tools: Unlocking Market Insights

Effective market analysis is a cornerstone of MM2 trading values. To succeed, traders must have access to reliable tools that provide real-time data and insights. Some of the most popular market analysis tools include:

- TradingView: A versatile platform offering advanced charting tools and community-driven insights.

- Bloomberg Terminal: A powerful tool for accessing real-time market data, news, and analytics.

- Yahoo Finance: A free platform offering a wealth of financial data and news for traders of all levels.

By leveraging these tools, traders can gain a comprehensive understanding of market dynamics and make data-driven decisions.

Analyzing Markets Through MM2 Trading Values

Market analysis is an integral component of MM2 trading values. By examining market trends and conditions, traders can identify opportunities for profit and manage risk effectively. Key approaches to market analysis include:

- Technical Analysis: Using charts and indicators to predict price movements based on historical patterns.

- Fundamental Analysis: Evaluating economic and financial factors that influence asset prices, such as earnings reports and interest rates.

- Sentiment Analysis: Assessing investor attitudes and market sentiment to anticipate price shifts and market sentiment.

By combining these methods, traders can develop a holistic view of the market, enabling them to make informed and strategic trading decisions.

Managing Risk in MM2 Trading

Risk management is a critical aspect of MM2 trading values. Implementing effective risk management strategies is essential for protecting capital and maximizing returns. Some key risk management techniques include:

- Stop-Loss Orders: Setting predetermined levels to limit potential losses and protect your trading account.

- Diversification: Spreading investments across different asset classes to reduce exposure to any single market or asset.

- Risk-Reward Ratios: Ensuring that the potential reward of a trade outweighs the associated risk to maintain profitability.

Incorporating these techniques into your trading strategy can help you manage risk effectively and achieve long-term success in MM2 trading.

The Psychology Behind Successful MM2 Trading

The psychology of trading plays a vital role in MM2 trading values. Understanding and managing emotions is crucial for making rational decisions and avoiding costly mistakes. Common psychological pitfalls in trading include:

- Overtrading: Engaging in excessive trading without proper analysis, leading to unnecessary risk and reduced profitability.

- Emotional Trading: Allowing emotions like fear or greed to dictate trading decisions, resulting in suboptimal outcomes.

- Revenge Trading: Taking unnecessary risks to recoup losses, often leading to further financial damage.

By adopting a disciplined approach to trading and maintaining focus on your long-term goals, you can overcome these challenges and achieve success in MM2 trading.

Ensuring Legal Compliance in MM2 Trading

Legal compliance is a crucial consideration for MM2 trading values. Traders must ensure that their activities adhere to relevant laws and regulations to avoid potential legal issues. Key aspects of legal compliance in trading include:

- Registration: Registering with appropriate regulatory bodies to ensure legitimacy and transparency.

- Anti-Money Laundering (AML): Complying with regulations designed to prevent the use of financial systems for illicit activities.

- Tax Obligations: Meeting all tax requirements to avoid penalties and ensure financial accountability.

Staying informed about legal requirements and adhering to them is essential for maintaining a successful and ethical trading practice.

Emerging Trends in MM2 Trading Values

The future of MM2 trading values is shaped by emerging technologies and evolving market trends. As the financial landscape continues to transform, traders must stay informed and adapt to these developments to remain competitive. Key trends to watch in MM2 trading values include:

- Artificial Intelligence and Machine Learning: The increasing use of AI and machine learning algorithms to analyze markets and execute trades with unparalleled precision.

- Sustainable Investing and ESG Criteria: The growing importance of environmental, social, and governance (ESG) factors in investment decisions.

- Decentralized Finance (DeFi): The rise of blockchain-based trading platforms and decentralized financial systems offering new opportunities and challenges.

By staying ahead of these trends and integrating them into your trading strategy, you can position yourself for success in the evolving world of MM2 trading values.

Kesimpulan

Detail Author:

- Name : Mabel Rath

- Username : fwitting

- Email : emmanuel90@gmail.com

- Birthdate : 1989-03-31

- Address : 8508 Dan Mountain Andrewburgh, ME 85973

- Phone : 540-867-3213

- Company : Balistreri and Sons

- Job : Biological Technician

- Bio : Error ab eos soluta aut nesciunt sint sequi provident. Commodi quos architecto autem occaecati omnis eveniet. Ea id facilis corporis aut minima enim id. Quis odit voluptatibus quae voluptas id.

Socials

tiktok:

- url : https://tiktok.com/@keara6295

- username : keara6295

- bio : Consequatur in a aperiam rerum iusto. Et maiores debitis expedita eum quo.

- followers : 5856

- following : 51

twitter:

- url : https://twitter.com/haley1971

- username : haley1971

- bio : Aspernatur praesentium ipsa porro totam vel et perferendis velit. Facilis ex possimus sunt sit dolore.

- followers : 4945

- following : 413

instagram:

- url : https://instagram.com/keara9601

- username : keara9601

- bio : Recusandae tenetur tempora sit aut quia eos. Laborum dicta quis ipsa eos repudiandae aut sit.

- followers : 1615

- following : 1297

facebook:

- url : https://facebook.com/haley2011

- username : haley2011

- bio : Consequuntur rerum earum quibusdam velit.

- followers : 6792

- following : 1248

linkedin:

- url : https://linkedin.com/in/keara3823

- username : keara3823

- bio : Amet esse amet accusantium rem nulla molestiae.

- followers : 2651

- following : 1570