Within the entertainment industry, tax management plays a critical role, often operating behind the scenes. The Tax Deduction at Source (TDS) framework is essential for maintaining compliance with tax regulations, especially for high-profile individuals like celebrities. This article delves into the TDS list, focusing on its relevance to the entertainment sector and its influence on 100 celebrities.

This detailed guide aims to provide comprehensive insights into the TDS system, its application within the entertainment industry, and its effects on top-tier celebrities. Whether you're a tax enthusiast, a finance professional, or simply curious about the financial aspects of celebrity life, this article will cover all you need to know.

As the entertainment industry continues to expand, understanding the intricacies of TDS becomes increasingly vital. This article will explore the complexities of the TDS list, its implications, and how it contributes to the financial health of both celebrities and the government.

- Skylar Digginsmithtats

- Films Justin Timberlake Has Been In

- Timeless Tours

- Quality Inn Hotel Ocean City Md

- Norman Names

Table of Contents

- Introduction to TDS

- Celebrity Biography

- TDS for the Entertainment Industry

- Why TDS is Important

- Celebrity TDS List

- How TDS Works

- Tax Compliance for Celebrities

- Celebrity Tax Issues

- TDS Regulations

- Conclusion and Action

Understanding TDS: A Fundamental Component of Taxation

Tax Deduction at Source (TDS) is a systematic approach implemented by the Indian government to collect taxes at the point of income generation. This mechanism serves as a preventive measure against tax evasion and ensures that individuals meet their tax obligations in a timely manner. The TDS system applies to numerous sectors, including the entertainment industry, where high-income earners such as celebrities must adhere to these regulations.

TDS ensures that a portion of an individual's income is deducted at the source and transferred directly to the government. This process simplifies tax collection and alleviates the burden on taxpayers during the financial year-end. For celebrities, comprehending TDS is essential as it significantly impacts their financial planning and compliance.

Key Features of TDS

- TDS is deducted at the source of income generation.

- It applies to various types of income, including salary, interest, and royalties.

- The rate of TDS varies depending on the type of income and applicable regulations.

Celebrity Profiles: An Insight into High-Profile Taxpayers

To gain a deeper understanding of TDS in the context of celebrities, let's examine the biographical details of some prominent figures in the entertainment industry. Below is a concise overview of a few notable personalities whose financial activities are closely monitored by tax authorities.

- Bluesongs Lyrics

- Millbutn Deli

- Hilton Hotels On Duvaltreet Key West

- Tom And Jerry 2020 Cast

- Alice Braga Moraes

| Name | Age | Occupation | Net Worth |

|---|---|---|---|

| Leonardo DiCaprio | 48 | Actor | $260 Million |

| Taylor Swift | 33 | Singer | $900 Million |

| Shah Rukh Khan | 58 | Actor | $660 Million |

TDS in the Entertainment Sector: Ensuring Compliance

The entertainment industry is a significant contributor to the economy, and its high-income earners are subject to stringent tax regulations. TDS plays a pivotal role in ensuring that celebrities and other professionals in the industry remain compliant with tax laws.

Celebrities often derive income from diverse sources, including film remuneration, endorsements, and live performances. Each of these sources is subject to TDS, with rates varying based on the nature of the income. For example, TDS on royalties is typically higher than that on salary income.

Examples of TDS in Entertainment

- Film remuneration: 10% TDS on payments exceeding ₹30,000.

- Endorsements: 20% TDS on payments exceeding ₹30,000.

- Live performances: 30% TDS on payments exceeding ₹30,000.

The Significance of TDS in the Tax System

TDS is an indispensable component of the tax system, ensuring that individuals and businesses contribute to the country's revenue efficiently and promptly. For celebrities, TDS aids in managing their finances effectively while maintaining compliance with tax regulations.

A primary advantage of TDS is its ability to streamline the tax payment process. Instead of paying taxes at the financial year-end, individuals can fulfill their obligations throughout the year. This method reduces the likelihood of tax evasion and guarantees a steady flow of revenue for the government.

Benefits of TDS

- Lessens the burden of tax payment at the end of the year.

- Ensures timely tax collection.

- Prevents tax evasion and promotes compliance.

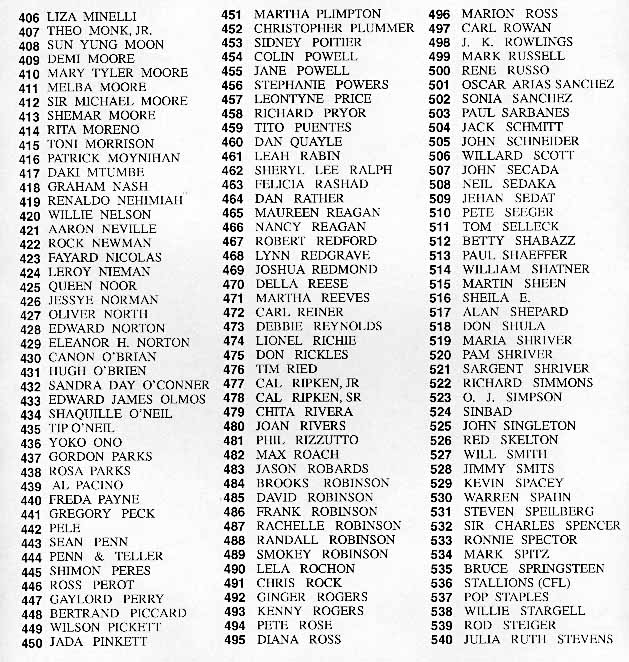

A Comprehensive List of Celebrities Subject to TDS

Compiling a thorough list of 100 celebrities with TDS obligations necessitates a detailed understanding of their income sources and compliance status. Below are some notable examples of celebrities who are subject to TDS:

- Salman Khan

- Aishwarya Rai Bachchan

- Rihanna

- Beyoncé

- Tom Cruise

Each of these celebrities earns income from multiple sources, making TDS an integral part of their financial management. The rates and thresholds for TDS vary depending on the nature of their income and applicable regulations.

The Mechanics of TDS: A Step-by-Step Guide

TDS operates on the principle of deducting a portion of an individual's income at the source and transferring it directly to the government. The process involves the following steps:

- Identification of the income source.

- Calculation of the applicable TDS rate.

- Deduction of the TDS amount from the payment.

- Submission of the TDS amount to the government.

For celebrities, this process is typically managed by their accountants or financial advisors, ensuring compliance with tax regulations.

TDS Rates

TDS rates vary depending on the type of income. Below is a summary of TDS rates for common income sources in the entertainment industry:

- Salaries: 10%

- Royalties: 20%

- Endorsements: 20%

Ensuring Tax Compliance for Celebrities

Tax compliance is a crucial aspect of financial management for celebrities. Non-compliance with tax regulations can lead to penalties, legal complications, and reputational damage. To ensure compliance, celebrities frequently collaborate with tax professionals specializing in entertainment law.

Some key steps in ensuring tax compliance include:

- Regular monitoring of income sources.

- Accurate record-keeping of payments and deductions.

- Timely submission of tax returns.

Common Tax Challenges for Celebrities

Celebrities encounter unique challenges when it comes to tax compliance. Some common issues include:

- Complex income sources requiring specialized tax treatment.

- International tax obligations arising from global earnings.

- High-profile audits and investigations conducted by tax authorities.

Navigating Celebrity Tax Issues

Despite their wealth and access to financial advisors, celebrities are not exempt from tax issues. Notable cases involve high-profile audits, disputes with tax authorities, and allegations of tax evasion. These cases underscore the importance of proper tax planning and compliance.

For instance, several celebrities have faced scrutiny over offshore accounts and investments. Tax authorities worldwide have intensified efforts to ensure that high-net-worth individuals, including celebrities, fulfill their tax obligations.

Strategies for Preventing Tax Issues

- Engage experienced tax professionals for advice and planning.

- Regularly review financial statements and tax filings.

- Stay informed about changes in tax laws and regulations.

TDS Regulations: Governing the Tax Framework

TDS regulations are governed by the Income Tax Act, which provides detailed guidelines on the application and enforcement of TDS. These regulations ensure that individuals and businesses comply with tax obligations and contribute to the country's revenue.

Key aspects of TDS regulations include:

- Threshold limits for TDS deduction.

- Procedures for filing TDS returns.

- Penalties for non-compliance with TDS rules.

Recent Developments in TDS Regulations

The government frequently updates TDS regulations to address emerging challenges and enhance compliance. Recent updates include:

- Introduction of new TDS rates for specific income types.

- Enhanced reporting requirements for high-income earners.

- Increased penalties for late submission of TDS returns.

Final Thoughts and Next Steps

In summary, the TDS system plays a critical role in ensuring tax compliance for celebrities and other high-income earners in the entertainment industry. By understanding the intricacies of TDS and adhering to the regulations, celebrities can manage their finances effectively while contributing to the country's revenue.

We encourage readers to share this article with others who may benefit from the information provided. Additionally, feel free to leave comments or questions below, and we will be happy to address them. For more insights into tax management and financial planning, explore our other articles on the website.

Detail Author:

- Name : Miss Katelyn Hermann

- Username : rsauer

- Email : lind.regan@hotmail.com

- Birthdate : 1986-06-20

- Address : 69761 Gavin Plaza South Dorcas, NC 79652-1209

- Phone : +1-858-676-2587

- Company : Monahan, Hirthe and Hammes

- Job : Urban Planner

- Bio : Qui eius mollitia asperiores deserunt quia iure quia. Numquam architecto molestiae autem odio veniam laudantium in. Recusandae voluptates vitae aut id impedit consectetur.

Socials

linkedin:

- url : https://linkedin.com/in/jaskolski2007

- username : jaskolski2007

- bio : Et quia quidem quia aut vero ut.

- followers : 3014

- following : 1340

tiktok:

- url : https://tiktok.com/@oscar_jaskolski

- username : oscar_jaskolski

- bio : Et velit est perferendis non. Recusandae dolores enim voluptas molestias.

- followers : 994

- following : 1155